How do I reconcile Gift Cards in my daily POS report?

This article explains how Gift Card sales are reported and how they should be treated when their value is ultimately spent on goods and services.

Gift Card Reconciliation | Clover Reports

When a gift card is sold via the Clover POS (or any POS), it is automatically recorded as a non-revenue sale in your Clover End of Day reporting.

Non-revenue sales are sales for which payment is taken in advance of the delivery of the item or service. A non-revenue item is therefore a transaction that does not add to the net revenue of a business at the time of the sale.

VAT is not collected for non-revenue items at the time of "sale", rather it is applied when the gift card is spent in your business at a future date.

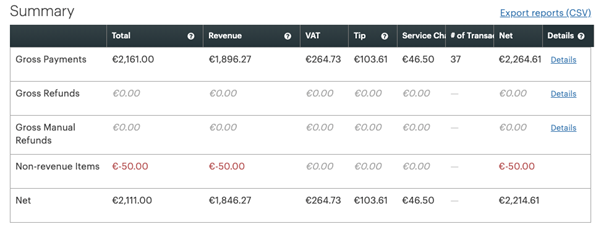

The below example shows how Clover records such transactions:

In the screenshot above we see a summary of a Payments Report in Clover. Within this report, we have included a single gift card sale for the amount of €50.00.

This €50.00 gift card sale is recorded as a non-revenue item (highlighted in red) and is the difference between the Gross Revenue of €1,896.27, and the Net Revenue of €1,846.27, as recorded.

It is important to realise that gift card values sold are considered an outstanding liability, and will not be become revenue until the value of the gift card is redeemed.

There will be instances where a gift card value is never redeemed. In such cases it is a business decision as and when they consider a long-standing gift card liability as revenue, and LoyLap recommends all our clients speak with a financial advisor or your accountant on how best to do this.

![Web-colour (1).png]](https://support.loylap.com/hs-fs/hubfs/Web-colour%20(1).png?width=104&height=50&name=Web-colour%20(1).png)